What Is A Commercial Vehicle For Vat Purposes . Vat registered businesses can use this list to determine. So when is a van a van?. What is a vat qualifying vehicle? — an overview. — as accountants, we often get asked if a vehicle is a commercial vehicle (van) or a car for vat purposes. Car derived vans and combi vans. hmrc considers that this type of vehicle is a commercial vehicle for vat purposes if it meets either of the following conditions: — most businesses understand that they can claim input vat on commercial vehicles, unlike cars on which the vat is blocked. It has a payload of more. A car to which vat applies is any motor vehicle normally used on public roads with three or more. — hm revenue and customs: — it is important to understand whether a vehicle is a van or a car for the purposes of vat input tax claims, vat fuel.

from loconav.com

hmrc considers that this type of vehicle is a commercial vehicle for vat purposes if it meets either of the following conditions: It has a payload of more. — hm revenue and customs: So when is a van a van?. Car derived vans and combi vans. — most businesses understand that they can claim input vat on commercial vehicles, unlike cars on which the vat is blocked. — an overview. — it is important to understand whether a vehicle is a van or a car for the purposes of vat input tax claims, vat fuel. What is a vat qualifying vehicle? A car to which vat applies is any motor vehicle normally used on public roads with three or more.

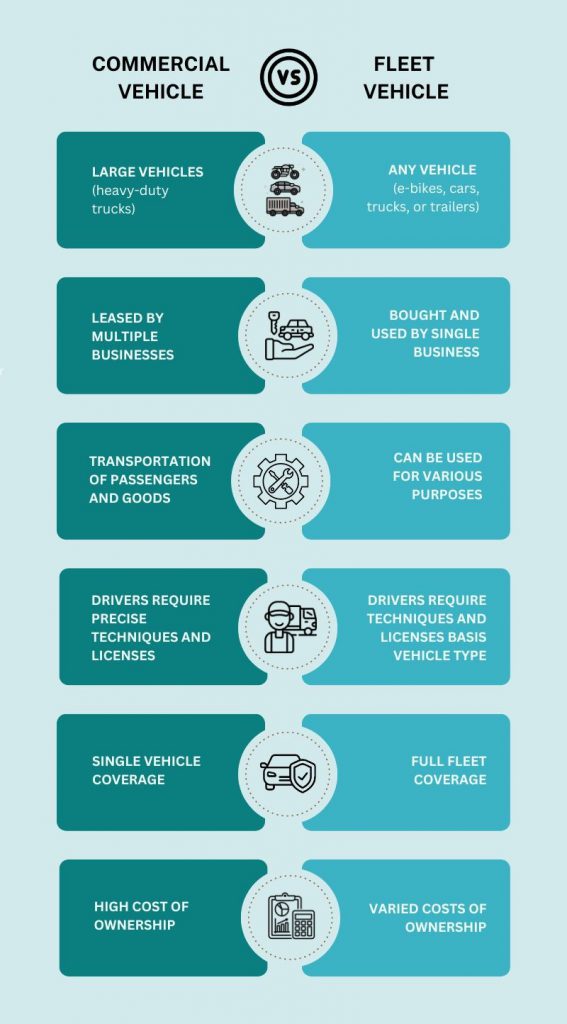

Commercial vs Fleet Vehicle What Makes Them Different

What Is A Commercial Vehicle For Vat Purposes — it is important to understand whether a vehicle is a van or a car for the purposes of vat input tax claims, vat fuel. What is a vat qualifying vehicle? — as accountants, we often get asked if a vehicle is a commercial vehicle (van) or a car for vat purposes. — most businesses understand that they can claim input vat on commercial vehicles, unlike cars on which the vat is blocked. A car to which vat applies is any motor vehicle normally used on public roads with three or more. Vat registered businesses can use this list to determine. Car derived vans and combi vans. — it is important to understand whether a vehicle is a van or a car for the purposes of vat input tax claims, vat fuel. — an overview. — hm revenue and customs: So when is a van a van?. hmrc considers that this type of vehicle is a commercial vehicle for vat purposes if it meets either of the following conditions: It has a payload of more.

From cruseburke.co.uk

Is There VAT on Commercial Vehicles? CruseBurke What Is A Commercial Vehicle For Vat Purposes — as accountants, we often get asked if a vehicle is a commercial vehicle (van) or a car for vat purposes. — most businesses understand that they can claim input vat on commercial vehicles, unlike cars on which the vat is blocked. — it is important to understand whether a vehicle is a van or a car. What Is A Commercial Vehicle For Vat Purposes.

From www.scribd.com

Mnt Vat Form Value Added Tax Taxes What Is A Commercial Vehicle For Vat Purposes What is a vat qualifying vehicle? So when is a van a van?. A car to which vat applies is any motor vehicle normally used on public roads with three or more. — hm revenue and customs: — it is important to understand whether a vehicle is a van or a car for the purposes of vat input. What Is A Commercial Vehicle For Vat Purposes.

From www.upela.com

Guide for your commercial invoices example and definition What Is A Commercial Vehicle For Vat Purposes Vat registered businesses can use this list to determine. Car derived vans and combi vans. — an overview. hmrc considers that this type of vehicle is a commercial vehicle for vat purposes if it meets either of the following conditions: It has a payload of more. So when is a van a van?. A car to which vat. What Is A Commercial Vehicle For Vat Purposes.

From slideplayer.com

Value Added Tax Calculation of VAT Liability Calculation of Input VAT What Is A Commercial Vehicle For Vat Purposes — most businesses understand that they can claim input vat on commercial vehicles, unlike cars on which the vat is blocked. Car derived vans and combi vans. — it is important to understand whether a vehicle is a van or a car for the purposes of vat input tax claims, vat fuel. So when is a van a. What Is A Commercial Vehicle For Vat Purposes.

From solatatech.com

Commercial Invoice What is it and when do I need one? (2023) What Is A Commercial Vehicle For Vat Purposes hmrc considers that this type of vehicle is a commercial vehicle for vat purposes if it meets either of the following conditions: — hm revenue and customs: So when is a van a van?. — it is important to understand whether a vehicle is a van or a car for the purposes of vat input tax claims,. What Is A Commercial Vehicle For Vat Purposes.

From www.branchor.com

The Ultimate Guide to VAT Numbers What They Are and Why Your Business What Is A Commercial Vehicle For Vat Purposes So when is a van a van?. hmrc considers that this type of vehicle is a commercial vehicle for vat purposes if it meets either of the following conditions: A car to which vat applies is any motor vehicle normally used on public roads with three or more. — most businesses understand that they can claim input vat. What Is A Commercial Vehicle For Vat Purposes.

From slideplayer.com

Presentation on VAT ECAS inar Tim Hayes ppt download What Is A Commercial Vehicle For Vat Purposes — it is important to understand whether a vehicle is a van or a car for the purposes of vat input tax claims, vat fuel. — as accountants, we often get asked if a vehicle is a commercial vehicle (van) or a car for vat purposes. Vat registered businesses can use this list to determine. What is a. What Is A Commercial Vehicle For Vat Purposes.

From uaevatregistration.com

Demystifying VAT for Commercial Property in the UAE A Complete Guide What Is A Commercial Vehicle For Vat Purposes — an overview. So when is a van a van?. A car to which vat applies is any motor vehicle normally used on public roads with three or more. hmrc considers that this type of vehicle is a commercial vehicle for vat purposes if it meets either of the following conditions: — most businesses understand that they. What Is A Commercial Vehicle For Vat Purposes.

From blog.shorts.uk.com

VAT and cars Buying, Selling & Leasing What Is A Commercial Vehicle For Vat Purposes Car derived vans and combi vans. — most businesses understand that they can claim input vat on commercial vehicles, unlike cars on which the vat is blocked. — it is important to understand whether a vehicle is a van or a car for the purposes of vat input tax claims, vat fuel. So when is a van a. What Is A Commercial Vehicle For Vat Purposes.

From blog.shorts.uk.com

Claiming VAT on commercial vehicles What Is A Commercial Vehicle For Vat Purposes — it is important to understand whether a vehicle is a van or a car for the purposes of vat input tax claims, vat fuel. — an overview. What is a vat qualifying vehicle? hmrc considers that this type of vehicle is a commercial vehicle for vat purposes if it meets either of the following conditions: Car. What Is A Commercial Vehicle For Vat Purposes.

From www.ukpropertyaccountants.co.uk

VAT On Commercial Property What You Need to Know What Is A Commercial Vehicle For Vat Purposes So when is a van a van?. — an overview. Vat registered businesses can use this list to determine. — most businesses understand that they can claim input vat on commercial vehicles, unlike cars on which the vat is blocked. — hm revenue and customs: — it is important to understand whether a vehicle is a. What Is A Commercial Vehicle For Vat Purposes.

From www.saint.co.uk

VAT Common Pitfalls commercial vehicles Saint What Is A Commercial Vehicle For Vat Purposes — an overview. A car to which vat applies is any motor vehicle normally used on public roads with three or more. Car derived vans and combi vans. So when is a van a van?. — it is important to understand whether a vehicle is a van or a car for the purposes of vat input tax claims,. What Is A Commercial Vehicle For Vat Purposes.

From loconav.com

Commercial vs Fleet Vehicle What Makes Them Different What Is A Commercial Vehicle For Vat Purposes — it is important to understand whether a vehicle is a van or a car for the purposes of vat input tax claims, vat fuel. hmrc considers that this type of vehicle is a commercial vehicle for vat purposes if it meets either of the following conditions: A car to which vat applies is any motor vehicle normally. What Is A Commercial Vehicle For Vat Purposes.

From www.slideserve.com

PPT The VAT Return PowerPoint Presentation, free download ID6698656 What Is A Commercial Vehicle For Vat Purposes — most businesses understand that they can claim input vat on commercial vehicles, unlike cars on which the vat is blocked. So when is a van a van?. Vat registered businesses can use this list to determine. — it is important to understand whether a vehicle is a van or a car for the purposes of vat input. What Is A Commercial Vehicle For Vat Purposes.

From eforms.com

Free International Commercial Invoice Templates PDF eForms What Is A Commercial Vehicle For Vat Purposes Vat registered businesses can use this list to determine. — as accountants, we often get asked if a vehicle is a commercial vehicle (van) or a car for vat purposes. — hm revenue and customs: So when is a van a van?. — it is important to understand whether a vehicle is a van or a car. What Is A Commercial Vehicle For Vat Purposes.

From www.animalia-life.club

Basic Commercial Invoice What Is A Commercial Vehicle For Vat Purposes Car derived vans and combi vans. — an overview. Vat registered businesses can use this list to determine. A car to which vat applies is any motor vehicle normally used on public roads with three or more. — most businesses understand that they can claim input vat on commercial vehicles, unlike cars on which the vat is blocked.. What Is A Commercial Vehicle For Vat Purposes.

From blog.pwc-tls.it

The qualification of the transactions related to the charging of What Is A Commercial Vehicle For Vat Purposes hmrc considers that this type of vehicle is a commercial vehicle for vat purposes if it meets either of the following conditions: Car derived vans and combi vans. — as accountants, we often get asked if a vehicle is a commercial vehicle (van) or a car for vat purposes. — most businesses understand that they can claim. What Is A Commercial Vehicle For Vat Purposes.

From www.youtube.com

Used Car Vehicle VAT Sales Invoice with quick fill out YouTube What Is A Commercial Vehicle For Vat Purposes What is a vat qualifying vehicle? — it is important to understand whether a vehicle is a van or a car for the purposes of vat input tax claims, vat fuel. Car derived vans and combi vans. — hm revenue and customs: So when is a van a van?. — an overview. — as accountants, we. What Is A Commercial Vehicle For Vat Purposes.